More people are choosing electric vehicles (EVs) for their green benefits and energy savings. EVs offer a way to avoid the ups and downs of fuel prices. But, owning an electric car means you need to think about electric car insurance. This article will explore affordable insurance options and what makes EV coverage different from traditional car insurance.

Even though electric cars can cost more to buy and fix, insurance companies are starting to offer better deals. They’re creating insurance plans that fit the needs of electric car owners. This could help make owning an EV more affordable.

Key Takeaways

- Electric car insurance premiums are typically higher due to the increased value and repair expenses of EVs, but affordable options exist.

- Insurance costs for EVs are dynamic, with premiums such as those for Tesla’s Model Y and Model 3 setting industry benchmarks.

- The cost of replacing electric car batteries and limited specialized repair shops contribute to the higher insurance costs.

- Unique risks to electric vehicles, including battery fires and cybersecurity threats, factor into premium calculations.

- Implementing strategies like policy bundling and taking advantage of EV-specific discounts can lead to significant savings on electric car insurance.

- The average insurance cost for a Tesla Model 3 has seen an increase over the years, highlighting the importance of continual policy review.

- Selecting an affordable provider like USAA, which has offered the cheapest coverage for some Tesla models, can mitigate costs.

Understanding Electric Car Insurance Basics

With more people choosing electric vehicles (EVs), knowing about electric car coverage is key. EVs from brands like Volvo, Volkswagen, Ford, and Nissan need special insurance. They have unique features like battery life and tech that affect insurance costs.

Insurance costs depend on the car’s value and repair costs. For example, a 2023 Tesla Model 3 costs about $2,574 a year to insure. This is because of its advanced tech and expensive batteries. But, with the right info and plans, you can find affordable insurance for electric cars.

| Vehicle Model | Annual Insurance Cost | Key Factors Influencing Cost |

|---|---|---|

| Tesla Model 3 | $2,574 | High-tech features, battery cost |

| Chevrolet Bolt | $2,275 | Battery replacement expenses |

| Nissan Leaf | $2,138 | Repair cost and parts availability |

| Ford Mustang Mach-E | $2,460 | Advanced technology, repair network |

Even though some models cost more to insure, companies like Travelers, Geico, USAA, and State Farm offer good rates. EV owners can also get federal tax credits of up to $7,500. This can help lower the cost of insurance. It’s smart to compare quotes from different providers to find the best deal.

Electric car coverage protects your EV investment and supports sustainable transport. Having the right electric auto insurance helps you enjoy the benefits while managing costs.

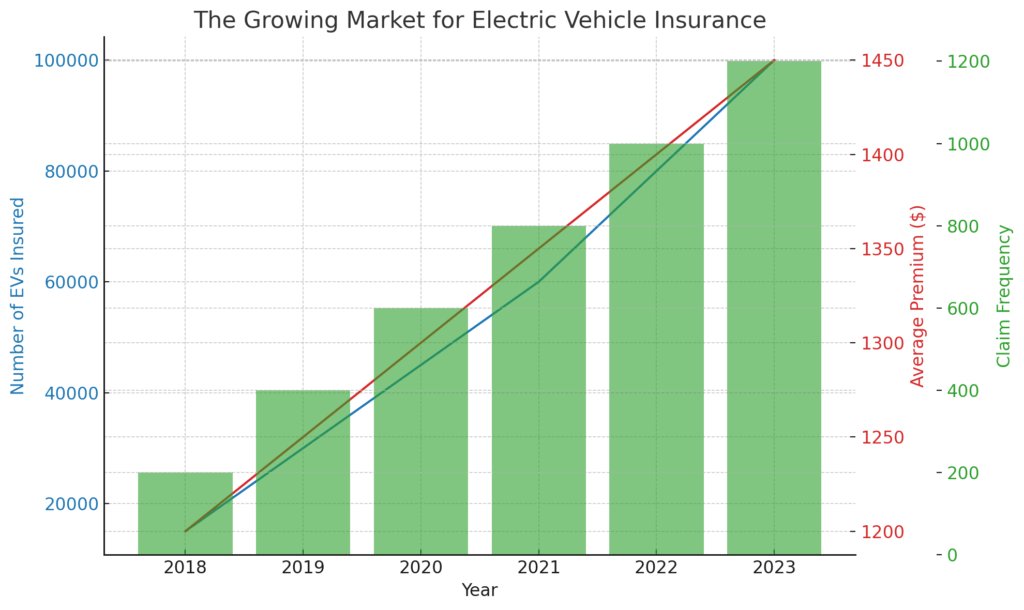

The Growing Market for Electric Vehicle Insurance

The electric car insurance market is getting bigger. It’s important to understand why and how it compares to traditional vehicles. More people own electric vehicles now, which means more need for special insurance policies. This has changed how insurance works for electric cars.

Factors Fueling the Growth of EV Insurance

Many things are making electric car insurance more popular. For one, technology and a move to sustainable energy make EVs more appealing. Also, battery costs have dropped by almost 90% since 2008, making EVs cheaper over time.

Governments offer big incentives like rebates and tax breaks. These help lower the cost of buying EVs and encourage people to switch from gas cars. Experts like Nick Vitali say insurance companies need to change to meet the needs of electric vehicles. This could lead to more specific insurance options.

Comparative Costs for Electric and Traditional Cars

Insuring electric cars usually costs more than traditional cars. This is because fixing and replacing parts in EVs is pricier. For example, replacing an EV battery can be expensive, affecting insurance costs.

The average cost of full-coverage insurance for electric cars is higher than for gas cars. This shows the extra risks and costs of EVs. But, it’s important to shop around for insurance as costs and security features change.

As electric vehicles become more common, the insurance industry is changing. More insurers are offering electric car insurance to meet the needs of eco-friendly drivers. With the market expected to grow a lot, electric car owners should look for insurance that fits their needs and covers electric vehicle specifics.

Electric Car Insurance Coverage Details

Exploring electric vehicle insurance shows a world of options for EV owners. When looking for an EV insurance policy, consider the tech and higher costs of EVs. EVs have advanced electronics and batteries that might need special repair skills. This can make electric vehicle coverage more expensive than for gas cars.

Some insurance plans offer protection against cyber threats and cover for self-driving features. Insurers that focus on electric vehicles know what owners need. For more info on coverage options and discounts, check out articles on electric vehicles.

There are also savings and incentives for EV owners. Some insurers give discounts for eco-friendly driving and home charging stations. It’s important for potential EV owners to know about these. Resources like Electric Car Insurance: Affordable Coverage Options offer updates on EV benefits and insurance.

Understanding EV costs starts with the high upfront prices. For example, EVs averaged $53,469 in July 2023, making insurance premiums higher than for traditional cars. Also, battery replacements can cost between $4,000 and $20,000, so you’ll need a good coverage plan for these costs.

The environmental benefits and tech advances of EVs are driving their popularity. Sales are up, and prices are getting closer to gas cars. This could lead to lower insurance rates for EVs as they become more common and insurers get used to them.

Average Insurance Costs for Popular EV Models

As electric vehicles (EVs) become more common, knowing about average electric car insurance costs is key for both new and current owners. Looking at popular models, especially Teslas, shows how affect costs. These trends help us understand what to expect now and in the future.

Cost Trends Over Recent Years

Electric vehicles used to be more expensive to insure, but the difference is getting smaller. Now, the average annual insurance premiums for electric vehicles are about $1,607, similar to gasoline cars. But, some models like the Tesla Model S cost more, around $3,365 a year in 2022, because they’re harder to fix.

Insurance rates change for many reasons. At first, EVs were pricier because they had special parts and were harder to repair. But as technology gets better and parts become cheaper, costs might go down. MoneyGeek shows how prices could drop as the market grows.

Insuring a Tesla: Luxury vs. Liability

Tesla insurance rates are usually higher than other EVs. This matches the brand’s high-end image and the fact that their cars can cost more to fix. The Tesla Model 3’s average annual insurance went from $2,753 in 2020 to $3,209 in 2022, showing how luxury EV insurance can change.

Insurance for Teslas is affected by their advanced tech and performance. If you’re thinking about getting a Tesla, you should know about these costs. EV Next Gen, written by Forhad, an EV fan, suggests considering the luxury and the higher insurance and upkeep costs.

Even though average electric car insurance costs are getting closer to traditional cars, there are still differences. This is especially true for luxury brands like Tesla. Knowing about EV insurance pricing trends helps owners make smart choices in the growing EV market.

Where to Purchase Electric Vehicle Insurance

Looking for EV insurance? You have many options, from traditional insurance companies to Tesla’s own products. These options cater to the unique needs of electric vehicles.

Traditional Insurers vs. Tesla’s Insurance Offering

Companies like State Farm and Lemonade now offer insurance for electric cars. They have discounts for things like good grades, safe driving, and bundling policies. These can help make electric vehicle insurance more affordable.

Tesla also offers its own insurance. It uses your car’s tech to set rates based on how you drive. This can lead to big savings for careful drivers or those who don’t drive much.

Seeking the Best Insurance Quotes for EVs

It’s important to compare insurance quotes for electric cars. Prices depend on where you live, your driving record, and your credit score. Electric cars are pricier and need more expensive repairs, so insurance costs can be higher.

Think about your car’s tech features, like regenerative braking or self-driving tools, when picking a policy. Make sure your insurance covers these special parts well. This affects how much you’ll pay for repairs or replacements.

To get EV insurance that fits your budget, look at quotes from several companies. Check how each policy matches your driving style, car type, and coverage needs. Many insurers offer online tools or apps, like Lemonade’s, for easy policy management.

Top Providers of Electric Car Insurance

Finding the right insurance is key for electric car owners. Travelers is a top choice, offering best electric car insurance for as low as $132 a month. This is 36% less than the average cost.

MAPFRE has the cheapest electric car insurance at $111 a month. This is almost half the usual cost, making it great for those watching their budget. USAA also offers low-cost insurance, with prices between $81 and $157 a month. It’s a top choice for electric vehicle insurance providers.

In Florida, electric car insurance costs the most at $313 a month. But in North Carolina, it’s the cheapest at $105. This shows how where you live affects insurance prices. On average, electric cars cost $44 more to insure each month than gas cars.

| Provider | Monthly Cost | Comparison to Average |

|---|---|---|

| MAPFRE | $111 | 46% Cheaper |

| Travelers | $132 | 36% Cheaper |

| USAA | $81 – $157 | Varies by State |

When looking for insurance, consider different coverage options and discounts. Discounts can be given for safe driving, having multiple policies, and features for electric cars.

It’s smart to check out various electric vehicle insurance providers. This helps find a good match for your budget and makes sure your electric car is well-protected.

Strategies for Finding Affordable Electric Car Insurance

More electric vehicles are on the road, making affordable electric car insurance a growing need. Luckily, there are ways and cheap EV insurance tips to keep costs down.

Start by comparing different insurance quotes to save money. This lets you see many rates and find the cheap electric car insurance that suits your budget. Also, bundling your electric car insurance with other policies like homeowners or renters can lead to discounts.

Using electric vehicle coverage discounts can also cut your insurance costs. These discounts are often given for a good driving record, safety devices, or owning a model like the Nissan Leaf or Chevrolet Bolt. Plus, you might get a federal credit of up to $7,500 for buying a new plug-in EV.

Raising your deductibles can make your insurance cheaper. This means you pay more if you have an accident, but your monthly payments go down. It’s a smart choice that can save you money over time if done right.

Learn more about electric vehicle coverage to see how certain discounts and policies can help you. This can lead to the best insurance deals for your situation.

- Compare multiple quotes to find market-comparative rates.

- Look out for bundling options with other insurance policies.

- Explore federal and insurer-specific discounts tailored for EV owners.

- Consider higher deductibles to lower periodic insurance payments.

In conclusion, electric cars might cost more to insure at first because they’re expensive and hard to fix. But, using these strategies can help lower those costs. This makes affordable electric car insurance easier to find.

Comparing Electric Auto Insurance Policies

The world of car insurance is changing fast, especially for electric cars. More people are choosing electric cars for their eco-friendly benefits. But, these cars also need special insurance coverage and cost more to insure.

The Value of Coverage and Global Comparison

In July 2023, electric vehicles cost an average of $53,469, while gas cars were about $48,334. This means electric cars cost more to insure because they are pricier and harder to fix. For example, fixing an EV battery can cost between $4,000 and $20,000, unlike the $100 to $200 for gas cars.

This difference affects how we compare electric car insurance. It shows why we need to look at costs from around the world.

Policy Features Tailored for Electric Vehicles

Electric cars need special insurance options. For example, Tesla offers a package for self-driving electric cars. Some companies give discounts for electric and hybrid cars, like Geico and State Farm, offering up to 10% off.

Experts like Janet Ruiz say EV repairs are getting easier. This is making electric car insurance more competitive with gas cars. It’s pushing companies to offer policies that meet the needs of electric car owners.